Turn a Government Shutdown Into an Opportunity to Thrive

The government has shut down again, this time mostly over healthcare subsidies. We’ve seen shutdowns before, and we’ll see more in the future.

As frustrating as they are, shutdowns remind us that uncertainty is the only constant. Instead of just surviving, I want to show you how to thrive during and after one. Out of the 750,000 federal employees furloughed, surely some of you read Financial Samurai—and believe it or not, this could be one of the best things that’s ever happened to you.

For everyone else—the non-federal workers—the impact is usually minor: no Blue Angels rattling windows and terrifying pets, or limited access to a national park. But Uncle Sam will still collect your taxes while “essential” employees keep the machine running without pay.

Three Groups, Three Approaches To The Shutdown

Shutdowns split people into three groups:

- The furloughed (~750,000) — suddenly free from work, but also free from pay. Ironically, this group has the most flexibility and opportunity.

- The essential (~420,000) — the unsung heroes keeping the system going without a paycheck. They deserve far more recognition.

- Everyone else — private-sector workers, taxpayers, the self-employed. Even if you’re not directly affected, this is a good moment to stress-test your finances.

Each group can either dwell on frustration or get stronger. Given there’s nothing any of us can do to prevent a shutdown or open the government back up, let’s choose stronger.

Never Let a Government Shutdown Go to Waste

I’ve lived through enough setbacks to know everything, good and bad, is temporary. Shutdowns included.

When I walked away from my finance job in 2012 with a severance, I went from a multiple six-figure income to $0. No biweekly paycheck. No health benefits. No year-end bonus. Just silence.

The first three months were tough. I had spent my entire adult life tied to a paycheck, and suddenly the rope was cut. But once the fear wore off, the joy of freedom outweighed the loss of income. The uncertainty, instead of crushing me, became fuel. I built something more secure than my old job ever was.

A government shutdown is the same. One day the paycheck’s there. The next, it isn’t. There’s an uneasiness if you’re living paycheck-to-paycheck. But if you play it right, this temporary disruption can spark something lasting – resilience, new income streams, and maybe even a better life.

And when the government inevitably reopens, you’ll get back pay for all the time you didn’t work. Not bad!

So let’s talk about how to make the most of this moment so you can not only survive, but thrive.

1. Understand the Past: Everything Is Temporary

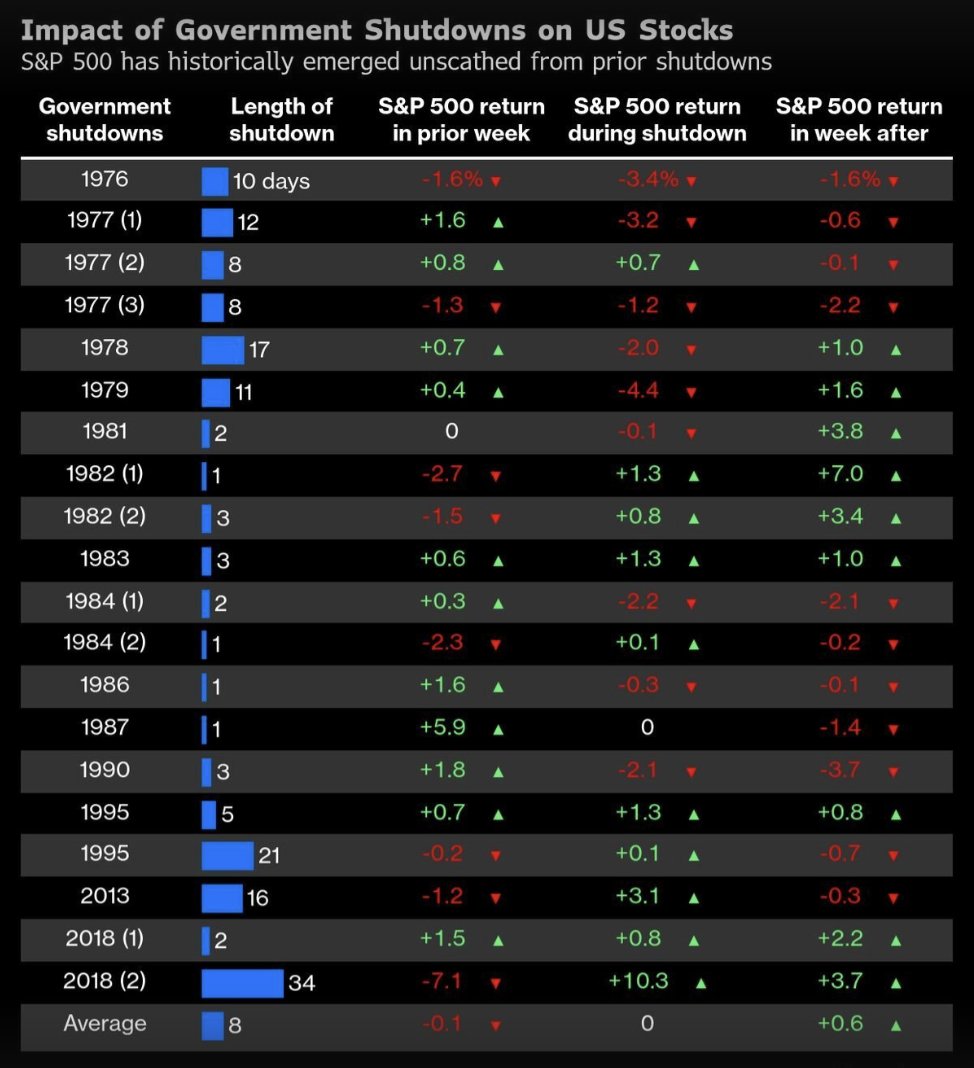

Not knowing how long a shutdown or downturn will last is what makes us anxious. But uncertainty is also what creates opportunity. The longest shutdown in history dragged on for 34 days in 2018.

If you can handle the idea of a month without pay, you’ll already feel stronger. If you can mentally prepare for two months, you’ll turn fear into confidence and come out ahead no matter what.

2. Finally Explore Different Money-Making Opportunities

Furloughed employees are in a non-pay, non-duty status, which means you can work elsewhere. Some drive for Uber, deliver for DoorDash, tutor, freelance, or do handyman jobs.

Back in 2014 and 2015, I gave over 500 Uber rides to write about the experience. I earned $20–$38 an hour, and if I had really needed the money, I could have cleared close to $4,000 a month. Even at half that today, that’s still almost $2,000, plenty to pay for groceries, utilities, and a portion of rent.

Other options: TaskRabbit, Rover, Craigslist gigs. Assemble furniture, walk dogs, teach guitar or pickleball. Every one of you has a monetizable skill. The shutdown is your permission slip to use it. Frankly, I’m shocked pickleball instructors are now charging up to $140/hour.

3. Discover Your Entrepreneurial Dreams

With a full-time job, it’s hard to pursue anything entrepreneurial. But now you’ve got time and mental bandwidth.

Start that website. Create the online course. Draft the business plan. You’ll eventually get back pay when the government reopens, so you can take a swing now with little downside.

Financial Samurai was born in July 2009 during the financial crisis. Fear of layoffs pushed me to stop making excuses and start writing. When I negotiated my severance in 2012, I took some time off and then began to focus. That decision not only gave me purpose, but also created financial stability years later that I never would have imagined.

The lesson? Fear is fuel. Uncertainty can be the push you need. A shutdown is just another nudge.

4. Treat the Shutdown as a Mini-Retirement or Sabbatical

One of my biggest regrets in finance was never taking a sabbatical. I was too worried about falling behind and missing out on a decent year-end bonus. Looking back, a break would’ve extended my career and maybe even changed the timing of starting a family. Oh, to be able to have paid parental leave to raise my children would have been the best benefit.

Instead, my “mini-retirement” began only after I permanently left my job in 2012. It was a shock at first, but it also opened up space to think about what really mattered. I wrote more. I got healthier. I spent more time with my parents and eventually started my family in 2017. If you have children, what a wonderful opportunity to spend more time with them!

So think of this shutdown as your sabbatical. Experiment with what early retirement feels like. Maybe you’ll discover you love the freedom. Maybe you’ll crave the stability. Either way, you’ll learn something invaluable about yourself.

When the government reopens, there’s a good chance they will offer severance packages again. If you felt great during the furlough period, I’d strongly consider accepting the government buyout. It’s clear the current administration wants to shrink the size of the government. So if your finances are strong enough, you might as well oblige and go where you’re more appreciated.

5. For Essential Employees: Stay Grounded and Strategic

If you’re still working without pay, thank you. It’s a tough spot, but you’re not powerless.

- If necessary, negotiate deferred payments with landlords, lenders, and utilities. Many are surprisingly flexible if you ask.

- Tap your emergency fund – this is what it’s for.

- Journal or write about your experience. There’s value in your story.

- Protect your health – stress is the real danger.

When this is over, you’ll feel good knowing you kept the system alive when it mattered. That kind of grit has value not only in the workplace, but also in building your own financial fortress. You may even start appreciating your paycheck even more once it resumes.

6. Take Care of Your Body and Get Everything Checked Out

One of the underrated perks of FIRE is being able to get things done during the week — no crowds, easier scheduling, and more availability everywhere. Use the government shutdown the same way. Book those doctor and dentist appointments you’ve been putting off. Get your annual physical, schedule that specialist visit, or finally take care of a filling or minor procedure. If you’ve been considering surgery, cosmetic or otherwise, now’s the time to plan and recover without using vacation days.

While you’re at it, treat this furlough like a personal health bootcamp. Exercise more, cook your own meals, and focus on resetting your habits. The longer the shutdown lasts, the longer your bootcamp — and the more likely you’ll come out of it stronger, leaner, and healthier. Who knows, this unexpected pause might be exactly what you needed to build lasting routines that improve your quality of life for years to come.

7. For Everyone Else: Observe and Prepare

Even if you’re not directly affected, use this as a stress test. Ask yourself:

- How long could I go without income?

- Do I have at least six months of expenses saved?

- Am I overly dependent on a single job or contract?

Shutdowns prove that nothing is guaranteed, not even a government paycheck. Build a redundancy of side incomes, cash buffers, strong relationships.

When I first left my job, I thought my passive income streams were enough. They were until our son was born five years later while both of us didn’t have jobs. During this time, some tenants moved out, while some investments underperformed. That reality check forced me to get more serious about saving more and generating extra income. It was uncomfortable, but it made me stronger.

Perspective Is Everything

Shutdowns come and go. What lasts is how you respond.

When the government reopens, and it always does, you can emerge stronger: with a sharper mindset, new skills, and maybe even a fresh income stream.

The 2008–2009 financial crisis felt like a disaster at the time, but it became the spark that changed my life. Losing so much money so quickly pushed me to slash expenses, save aggressively, asset allocate wisely, negotiate a severance, and ultimately start Financial Samurai. What looked like failure became the foundation of freedom.

So don’t just survive. Thrive. Use this moment as proof that true freedom doesn’t come from a paycheck – it comes from having options.

And when the back pay finally lands in your account, you’ll know you did more than wait it out. You turned uncertainty into opportunity, the essence of a Financial Samurai.

Readers, is this latest government shutdown affecting you? If so, how are you planning to turn a suboptimal situation into an opportunity? Or are you enjoying the unexpected time off, knowing back pay is almost guaranteed once the government reopens? If you were furloughed right now, would you feel relieved or anxious?

Subscribe To Financial Samurai

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population – and break free sooner.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here. Everything is written based on firsthand experience and expertise.