A $20 Million Net Worth Should Be Enough To Live Happy And Free

Needless to say, a $20 million net worth is a substantial amount of money. It firmly places you within the top 1% of net worth, with the current minimum threshold around $13 million.

Previously, we discussed how a $10 million net worth, and even a $5 million net worth, are both ideal amounts for retirement, depending on your location and expenses.

In this post, however, I thought it would be intriguing to profile people with a $20+ million net worth, explore how they achieved it, and what their plans are moving forward.

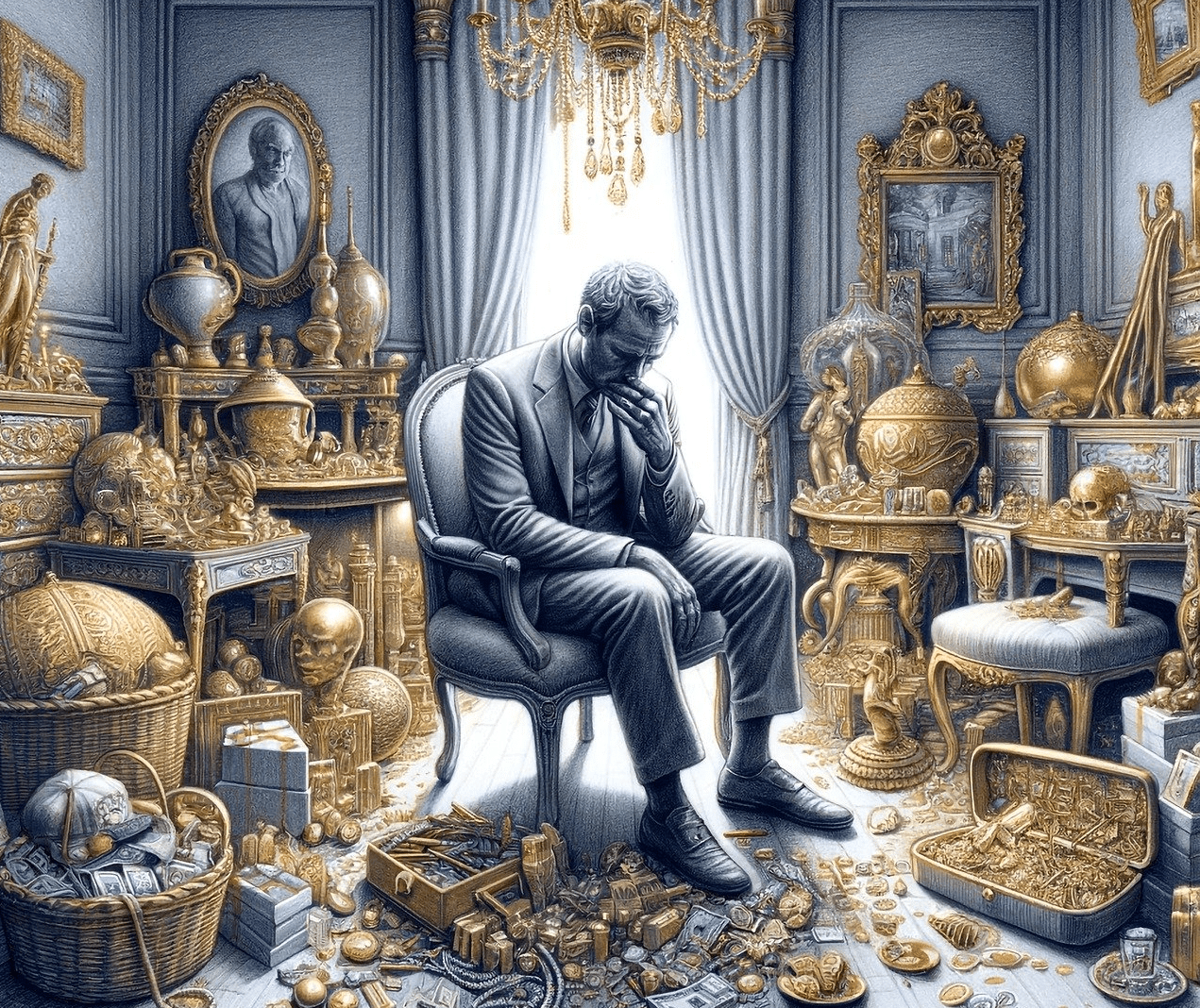

You might think having a $20+ million net worth is enough to guarantee happiness and freedom, but these individuals still share the same hopes and worries as many others with far less.

A $20 Million Net Worth Is Achievable With Enough Time And Discipline

Although achieving a $20 million net worth might seem like a pipe dream to some, it’s becoming more attainable due to inflation and investment returns. You just have to live long enough for your investments to reach that level!

For example, if you retired with a $3 million net worth fully invested in risk assets, after 20 years with a compound annual growth rate (CAGR) of 10%, you’d have just over $20 million. If we reduce the CAGR to a more conservative 6.5%, your $3 million would grow to $20 million in 30 years. Not bad! Stay healthy.

I start with $3 million because I believe it’s now the minimum amount to feel like a true millionaire. It’s also what I semi-retired with in 2012, and I like to write from firsthand experience. While inflation acts as a tailwind for our investments, it’s a headwind for our purchasing power.

It would be great to have a net worth of over $20 million in 20-30 years. But today, we’re discussing whether a $20 million net worth is enough to live a happy and free life.

Profiles Of People Who Have A $20 Million Net Worth

To better understand what it’s like to have a $20+ million net worth, I reached out to my newsletter subscribers, which includes over 60,000 people. I also talked to people I know who fit the profile.

Interestingly, though, having a $20 million net worth doesn’t yet place you in the ultra-high net worth category. That distinction begins at $30 million and above.

![]() Loading …

Loading …

Here’s what these decamillionaires had to say. I’ve edited the responses for clarity and flow. In the end, I’ll share some key takeaways to help you get to multi millionaire status as well.

Multimillionaire Profile #1: Husband (58), Wife (52), Two Kids – Following the Estate Tax Threshold

Our net worth currently falls between $19–$21 million, depending on how you value our primary residence ($4–$5 million) and our rental properties ($7–$8 million). The rest is mostly in individual stocks and one venture capital fund.

Our goal has always been to accumulate a net worth equal to the estate tax exemption threshold and then call it quits. Given that the estate tax threshold in 2024 is $13.61 million per person, and there are two of us, our target net worth is $27.22 million.

We don’t need more money, but as long as the estate tax threshold keeps increasing each year, we figure we might as well keep working. I earn between $700,000–$1,200,000 a year as a physician with my own practice.

My parents encouraged me to start investing in real estate as early as possible. They told me that in 20 years, I’d be tired of my work, and owning real estate would be a good way to generate retirement income. They were right.

There’s too much bureaucracy with insurance companies, and the pay has been declining. But it’s hard to quit because the money is steady and it still feels good helping others heal. So, I just keep going, treating wealth accumulation like a game to stay motivated.

Besides, I don’t know what I’d do with all my free time. I should start taking more vacations from now on.

Multimillionaire Profile #2: Husband (42), Wife (40), No Kids – Love Making Money

Our net worth is around $25 – 30 million. I run an online education company that teaches people how to make money online. In other words, I make money by teaching people how to make money online. Yes, I know—how meta.

I produce online courses, write books, run paid seminars, and have a show. Eighty percent of my net worth is in my company.

I’ve been hooked on making money since I was in college and haven’t been able to quit since. I first crossed a $10 million net worth threshold at around age 35, and the money keeps snowballing. My goal is to reach a $50+ million net worth, and then maybe I’ll take it easy.

We live in New York City and enjoy the finer things. We rent a luxury penthouse apartment, take great vacations, and occasionally fly private. My wife loves fashion and works as a fashion stylist. Her business doesn’t make much money, but it doesn’t matter. She’s doing what she wants.

Although my wife and I got married in 2018, we don’t have kids. We talked about it, but we enjoy our freedom and money too much as a child-free couple. At 40 years old, it’s a bit late for her to have kids anyway. She also didn’t do egg freezing as she met me in her 30s.

Multimillionaire Profile #3: Woman (47), Man (50), Two Kids – Good Work Life Balance

We’re unmarried but have two kids, ages eight and eleven. We met in college when we had nothing, and now our net worth is around $20 million. I work as a mid-level executive at a big tech company, and he’s a managing director at an investment bank.

Our combined income ranges from $800,000 to $2.5 million a year, depending on stock performance and year-end bonuses. We’ve both worked continuously for over 25 years, with no breaks for graduate school or sabbaticals.

The reason we didn’t marry earlier is that we ran the numbers and realized we’d pay between $15,000 and $22,000 more in taxes each year if we did. We didn’t think it was worth being financially penalized just for a marriage certificate.

By staying unmarried, we’ve saved at least $200,000 in taxes, which we’ve allocated to our children’s 529 plans. We’d rather fund our kids’ education than contribute to wasteful government spending.

Given my seniority at my tech company, I can work from home three days a week—or whenever I want. I average about 35 hours a week and make at least $500,000 every year. Working in big tech is ideal if you have kids. If you want to take a chance at a startup, do it before age 35.

At this pace, I can probably work until I’m 60. My husband, on the other hand, wants to retire ASAP. Maybe he’ll negotiate a severance package like Sam did next year. Let’s see how this year’s bonus turns out first.

Multimillionaire Profile #4: Husband (36), Husband (34), One Kid (3) – Got Lucky Twice

We both worked at a ridesharing company for six years before it went public. Within a year of the IPO, we cashed out for about $3 million each.

We then joined another startup when it was valued at around $500 million. After five years, the company raised a funding round that valued it at $10 billion. Our $500,000 in equity each is probably worth around $7 million after dilution. Together, our total net worth is roughly $20 million.

The “problem” is that only about 20% of our net worth is liquid, mostly in stocks and money market funds. We own a three-bedroom condo in an amenity-rich building that cost us $2 million, and we spent about $150,000 on surrogacy to have our daughter.

The $14 million in equity we have in our company is essentially a big lottery ticket. Unless we get acquired or go public, we can’t liquidate anything. There might be a secondary offering in the future where we could sell up to 10% of our stock, but that’s not available yet. With so many former unicorns never making it, we’ve conservatively halved our equity valuation in our net worth calculation.

Liquid net worth much lower

So realistically, our combined net worth is closer to $12 million, with $3 million mostly in the S&P 500, $1 million in Treasury bonds and cash, $1 million equity in our condo, and $7 million in company equity.

We feel extremely fortunate to have won the lottery twice. But we’re living closer to a $5 million net worth lifestyle than a $20 million one. Anything can change at any moment.

If you want to increase your chances of getting lucky, move to a city where there’s a lot of opportunity. We know a good handful of people worth 20 million in their 30s and 40s.

Multimillionaire Profile #5: Husband (52), Wife (44), Three Kids – Early Retirees

After over 25 years in the mutual fund industry after business school, I (the husband) decided to retire at age 51. I was the lead portfolio manager of an actively managed fund with about $8 billion in assets under management. Over the last five years, my average compensation was $2.2 million.

But, the active fund industry is in decline due to the rise of low-cost index funds and ETFs. While I had some really good years, outperforming my index by 5%–10%, there were also more bad years than I would have liked. My advice: invest most of your money in passive funds, but work at an active fund if you want to potentially make more money in your career.

My wife also recently decided to retire from teaching after 21 years. She made about $95,000 a year and was burnt out. Classroom sizes kept growing, and public funding kept shrinking. With three kids of our own (ages 5, 8, and 10), we’ve decided to embark on some slow travel abroad and homeschool them for a year or two.

We figure we’re still young enough to make this happen, and so are our kids. Once they hit middle school—and definitely high school—it becomes harder for them to adjust to a new environment. Plus, one of our kids has special needs, so we want to show him the world as much as possible before he can no longer walk or see well.

Our $20 million net worth composition

$8 million of our net worth is invested in the fund I managed. $4 million is in the S&P 500 index, $2 million is in Treasury bonds (1-2-year duration), $3 million is in four venture capital funds, $2 million is in a paid-off rental property that used to be our old home, and $5 million is in our paid-off house. So our net worth is around $23–$25 million.

The key to us building a $20+ million net worth was saving and investing 50%–70% of our income every year for over 25 years and taking more risk on average. Our net worth in 2020 was about $16 million, but it started to balloon after the pandemic.

We have an annual household budget of between $350,000 – $400,000 a year. Our expenses will go down by $160,000 when we pull our three kids from private school and travel. We are well past the investment threshold amount where we need to continue working for a living.

Multimillionaire Profile #6: Husband (78), Wife (75) – Max Frugality

We both worked for the government for 40 years until we retired in our early-60s. I joined the service after serving in Vietnam, and I met my wife while studying abroad for my master’s degree.

Our parents lived through the Great Depression, so they instilled in us a savings mindset. We appreciated the stability of real estate, so over a 30-year period, we bought several multifamily buildings in Northern Virginia. These properties are now paid off with a combined value of approximately $9 million.

My parents also invested in prime oceanfront real estate in Honolulu, which is now worth between $12-15 million. We inherited these properties 20 years ago when their value was much lower.

In addition to our real estate holdings, we retired with federal government pensions totaling about $135,000 a year, which adjusts annually for inflation. The most income we ever made from the government was around $200,000. Our pensions alone are sufficient to cover our annual expenses of roughly $85,000.

Hard to Spend More Money

Despite our net worth, we continue to live as we did in our 40s and 50s. For example, we retired to my parents’ old house, which hasn’t been updated since it was built in 1980. We also drive a $2,500 car that’s 30 years old.

I can’t recall the last time we bought new clothes. In fact, my wife prefers to declutter as much as possible. This way our children will have less to manage when we’re gone.

We’ve increased our spending on food delivery since the pandemic, but that’s about it for personal expenses. We regularly donate between $15,000 and $20,000 a year to charities. While this might seem modest given our net worth, it feels significant relative to our annual spending of $85,000.

Our Kids Don’t Rely on Us

Our proudest accomplishment are our three kids, who are financially independent due to their own frugality and successful careers. They are each worth between $2 and $5 million and never ask for anything. Instead, they call regularly to see how we are doing and if we need anything. However, we fully fund our three grandchildren’s college educations and enjoy hosting family visits and vacations.

Ultimately, our children and grandchildren will inherit our assets. We don’t feel compelled to spend more because we are content with our current lifestyle. We also feel good our kids will be responsible with the assets to keep generational wealth alive.

Key Takeaways from Those with a $20 Million Net Worth

Here are the key takeaways from the six multimillionaires:

- Accumulating Wealth as a Couple: It’s generally easier to build wealth as a couple. If you’re single, consider investing more time in finding a life partner.

- High-Paying Professions and Longevity: Working in high-paying jobs can accelerate wealth accumulation, but longevity in your career is equally crucial. Diligently saving and investing over 20+ years can lead to significant wealth thanks to the power of compounding.

- Net Worth Composition: The composition of your net worth affects your financial freedom and sense of wealth. If most of your net worth is tied up in illiquid assets like private company stock, it can be harder to enjoy a luxurious lifestyle.

- The Role of Luck: Luck plays a significant role in achieving exceptional wealth. Joining a company pre-IPO twice, for instance, is highly fortunate.

- The Challenge of Decumulation: It can be difficult to spend more money when you’re accustomed to saving substantial amounts. Wealth tends to snowball, making it even harder to spend down your wealth as you get older. Therefore, start practicing decumulating well before 60.

- Passing Down Financial Habits: Good financial habits are transferable to children. Therefore, concern about raising spoiled or entitled children may be exaggerated.

- Didn’t Get Rich Through Index Funds: To achieve next-level wealth, they pursued lucrative careers, saved aggressively, invested in real estate, and engaged in entrepreneurship. Investing in index funds was more of a means to preserve wealth.

- No Sense Of Greater Happiness: Unfortunately, it doesn’t seem like anybody is happier with a $20 million net worth. Instead, there might be more stress from figuring out how to manage such a large estate. Maybe $5 – $10 million is good enough to retire happy and free after all.

If you have a net worth of over $20 million, which is double the ideal amount to retire comfortably, I’d love to hear your story.

Get A Free Financial Checkup

For those with over $250,000 in investable assets who want a free financial checkup, you can schedule an appointment with an Empower financial advisor here. If you complete your two video calls with the advisor before October 31, 2024, you’ll receive a free $100 Visa gift card.

With stock market volatility returning and a potential recession on the horizon, it’s wise to get a second opinion from a professional. The ultra-wealthy do all the time so they can better enjoy their time elsewhere. The last thing you want is to be misallocated relative to your financial goals and risk tolerance. When you lose money, you ultimately lose precious time.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

To increase your chances of achieving financial independence, join 60,000+ readers and subscribe to my free Financial Samurai newsletter here.